SINGAPORE – Canadia Bank, one of Cambodia’s largest commercial banks, has partnered with IPification to integrate the next generation of mobile identity solutions. With IPification 1-click mobile authentication and phone verification, its users can now take advantage of increased security and a streamlined user experience of its mobile banking app.

In over 33 years of operations, Canadia Bank has become a pillar of the Cambodian banking sector. Today, as part of its vision to set best-in-class standards for customer experience and performance excellence, the bank is accelerating its digital transformation journey by enhancing the security and convenience of its mobile banking services.

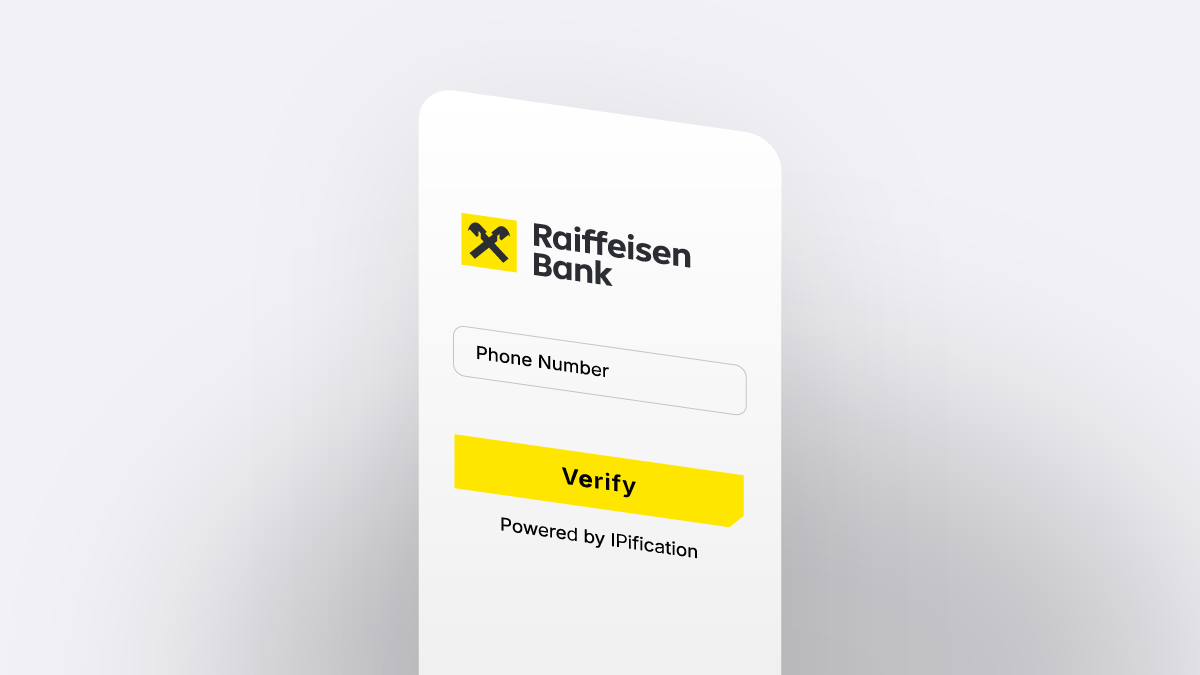

Through this integration, Canadia Bank users can now enjoy seamless onboarding and transaction verification via IPification’s mobile authentication and phone verification technology. The solution verifies users in milliseconds using their unique Mobile ID key, which is composed of SIM card, device, and network data. Customers simply enter their phone number and tap once to be securely authenticated — no passwords, SMS OTPs, or additional steps required.

The implementation significantly elevates the user experience by reducing friction during onboarding and login processes, while also enhancing the security of digital banking operations. This ultimately fosters greater trust, increases user acquisition, improves retention, and boosts engagement rates.

“We are proud to support Canadia Bank as they continue to lead Cambodia’s mobile banking evolution. By integrating IPification 1-click mobile authentication and phone verification solutions, they are delivering on their promise of providing secure, frictionless banking experiences, exactly what modern users expect.” — Stefan Kostic, CEO of IPification.

“Banking goes beyond transactions – it’s about fostering trusted relationships and partnerships. We are glad to partner with IPification and with its one-tap mobile authentication, Canadia Bank customers can log in, verify transactions, and access their accounts in seconds, without the hassle of passwords or waiting for SMS codes. This isn’t just about new technology — it’s about giving our customers more time, more convenience, and greater peace of mind every time they use the Canadia Bank App. As we advance our digital innovations, we remain committed to making everyday banking simpler, safer, and smarter for everyone, wherever they are.” — Mr. Chim Poly, Chief Digital Officer of Canadia Bank.

This partnership marks another significant milestone in the expansion of IPification services across Southeast Asia, enabling banks and fintech companies to meet today’s user expectations of both convenience and security through cutting-edge mobile identity solutions.